Become a member

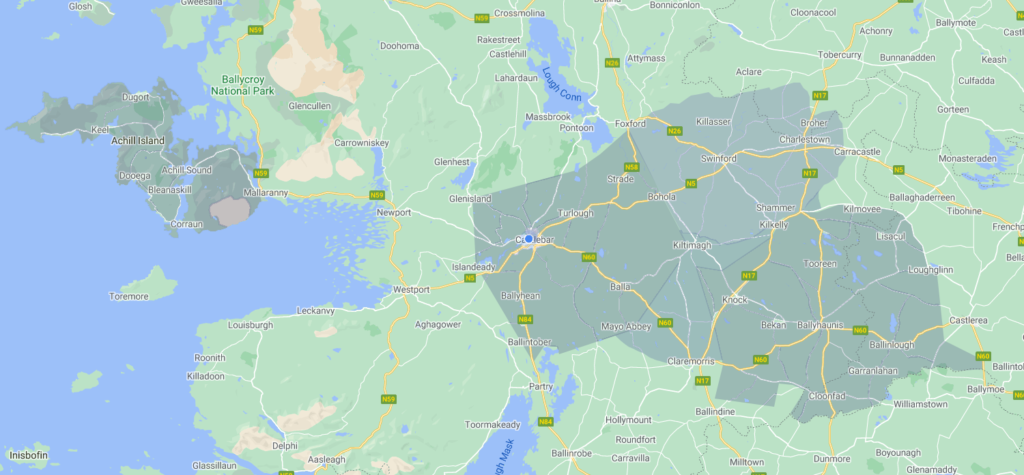

JOIN TODAY! LIVE, WORK or your family home is within the Achill, Balla, Ballyhaunis, Castlebar, Kiltimagh or Swinford Common Bond area? Simply apply online below or drop into any of our branches and we will be delighted to take you through the membership process.

Our Common Bond

In order to become a member of First Choice Credit Union you must satisfy the common bond criteria by either living or working in any of the following areas; Achill, Balla, Ballyhaunis, Castlebar, Kiltimagh or Swinford. Click the map to see the areas we cover.

What you need to join

Proof of Identity

A Valid Passport, Drivers Licence or National Identity Card

Proof of Address

Utility Bill, Original Bank Statement – within 6 months

Proof of PPS Number

Payslip, P60, Revenue Document

Entrance Fee

Entrance fee and minimum membership amount – €11 in total

Benefits of Membership

Online Banking & Mobile App

Access your account 24/7, view your account, transfer money or pay your bills.

Current Account & Debit Card

Globally accepted Mastercard® Debit Card, Free Contactless Payments, Overdraft & more

You can apply for a loan the same day you join.

Loan Protection & Life Savings Ins

Enjoy piece of mind on borrowings and savings at no cost to you.

Owned By You

We are a not-for-profit organisation owned by you our members.

Community Support

Your helping your local community when you become a member.

Reactivate your account

Reactivate, don't wait! Reactivate your account now.

Junior Membership Accounts

For further information on junior accounts, please click junior accounts button.

FAQ's

What is a credit union?

A financial co-operative, owned and controlled by its members, for its members.

Why do credit unions exist?

To service the financial needs of your community, on a not-for-profit basis, and to retain members’ savings in your community for the benefit of all the members.

Who owns a credit union?

The members own the credit union

Who runs First Choice Credit Union?

First Choice Credit Union is run by a voluntary board of directors who are elected by members at First Choice Credit Union AGM.

How much do I need to have in my account to be a member?

To be considered an active or full member you must have at least €10.00 in your share account.

What is the common bond?

The common bond is the factor which unites the members of a Credit Union together i.e. those living or working in the same area may join a credit union. It defines the area in which a credit union can operate. The common bond ensures that the savings of members of the community are available to fellow members as loans. The common bond is essentially people doing it for themselves. Our Common Bond centers on the townloands of Achill, Balla, Ballyhaunis, Castlebar, Kiltimagh and Swinford.

What exactly are Credit Union Shares?

All savings are called Shares in First Choice Credit Union. Each share represents €1 in value. So if a member has €5,000 saved, they in effect, hold 5,000 shares. Each year-end, the credit union pays a Dividend on the shares held by each member throughout the year. This dividend is credited into the members share account.

As a new member, how much can I hold in savings?

Please go to our Savings webpage for up to date information. Click here now: SAVINGS WEBPAGE

Do I have to save?

Members are encouraged to continue saving at all times, even when repaying a loan. When you save on a regular basis no matter how small the amount, you will be surprised how quickly your savings/shares can grow. Remember your savings/shares and your loan are protected by Loan Protection/Life Savings Insurance (LP/LS) at no extra cost.